Hi

I just published a video explaining that good call on NZDUSD I've made on 21 of February 2006.

Bear in mind that this is a selected successful call, after the fact, (typical for services :) ).

I've chosen this call as a good example of a nice C wave.

There are and will be calls that would not work as this one. Although there were good confirmations for this particular one:

It drop below Wave A end point (low) and below 61.8 Fib Extension. It also made below it's internal subwave A (or 1) end point (low) giving another confirmation for a C of a C and it made below my most important MAID (green line) indicating possibility of going to the next MAID (gray line). My modified RSI was also pointing down (not shown on this video), so anyway there was a strong confluence for calling this wave C at that time.

I'll leave you watch the video now.

Take care

ID

http://www.freewebs.com/waveid/video/NZD%20Call.html

KNOW WHAT OTHERS DON'T

Welcome to my Market Directions ramblings.

I mainly focus on Major Forex pairs.

The idea is to grasp Intermediate to Longer term market moves.

I use different aspects of Technical Analysis and I take into consideration economic news data, but just in conjunction with my technical analysis.

Comments and criticism are welcome as long as they are constructive and will help both readers and me to improve our understanding of markets moves.

Thursday, March 30, 2006

Monday, March 27, 2006

JPY update

It made only to 117.6 since my previous post, and broke down to mentioned support area of 116.9<>116.4 made low exactly at 116.4

It made only to 117.6 since my previous post, and broke down to mentioned support area of 116.9<>116.4 made low exactly at 116.4On the chart is what I consider a good argument for my view.

The fact that I see possible strong Dollar in other pairs at least in near term makes me uncomfortable a bit, but still this latest development gives me confidence in my view.

As you can see on the chart, C made to exactly 61.8 Fib Extension of the previous move, returning a strong IM drop down, which after a correction returned again a strong IM drop down.

Now 117.39 low (smaller wave 1 end) is critical for this drop to qualify for wave 1 of larger 3rd, and we need a 5th down to strengthen this view.

Break below wave 1 low 115.49 should give strong move down in a 3rd wave down.

Alternative is wave 1 being wave A IM of a ZZ, in which case 3rd will become C and will finish the drop down.

I haven't done a follow up of my Market Updates for a month, last call overshot my targets up significantly.

AUD was the best of all, pinpointly accurate, returning more than 400 pips since then and will probably make few hundreds more to just below 0.68. NZD also turned to an excellent call and it adds to what I mentioned somewhere before, that 3rds and Cs are the most easier to spot, predict and trade, with lowest risk and with greatest reward. I've looked at NZD because Joseph draw my attention on it and it returned almost 600 pips since than. I believe it will make some more before it finishes this drop.

I'll try preparing an update for EUR, GBP, CAD but don't expect too much.

ID

Joseph, NZD!

See my post (chart) from 21 Feb... This drop and the whole correction should be very close to bottom if not finished, probably 0.5990 to 0.5940 and the next move up to 0.65 to 0.67

We should wait and see the development before we decide if this would be continuation up of a larger degree C or just first leg A of B of larger B.

There is a slight chance of seeing one more move down (possible wave 5 if this drop C develops IM...) below mentioned target support of .599 <> .594 but even so I expect a min move up to .635<>.64 first.

Once again I don't follow NZD so take it with reserve.

ID

We should wait and see the development before we decide if this would be continuation up of a larger degree C or just first leg A of B of larger B.

There is a slight chance of seeing one more move down (possible wave 5 if this drop C develops IM...) below mentioned target support of .599 <> .594 but even so I expect a min move up to .635<>.64 first.

Once again I don't follow NZD so take it with reserve.

ID

Sunday, March 26, 2006

JPY point

Hi friends

I'm just taking a rest addressing some private issues.

I just want to point to something that deserves attention, especially to you Joseph.

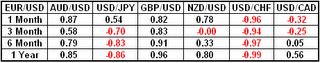

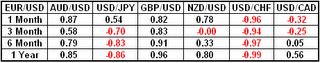

This is a Correlation Table from Dailyfx.com FXCM website.

As you can see on a yearly basis all pairs except USDCAD have had a fairly strong correlation with EURUSD. GBPUSD and USDCHF strong and constant correlation.

What is interesting and what I want to draw your attention at, is that USDJPY lost it's good correlation it had with EURUSD, and in fact shifted to a relatively good negative correlation last month.

(pay attention if the pair is XXX-USD or USD-XXX so USDJPY -0.86 is good positive correlation with EURUSD meaning both EUR and JPY moved in the same direction against the USD most of the time).

Below 116.90/40 is a good confirmation of a possible continuation down to 113.8 to 112.70 to 110.6 but if you want even better confirmation, break below 115.44 March 1 low will provide it.

Above recent high @ 118.48 and above 119.17 would make me consider 124 as a serious possibility.

Intraday, a most probable correction up to 117.75<>117.87 before any continuation down.

Take care all of you,

ID

I'm just taking a rest addressing some private issues.

I just want to point to something that deserves attention, especially to you Joseph.

This is a Correlation Table from Dailyfx.com FXCM website.

As you can see on a yearly basis all pairs except USDCAD have had a fairly strong correlation with EURUSD. GBPUSD and USDCHF strong and constant correlation.

What is interesting and what I want to draw your attention at, is that USDJPY lost it's good correlation it had with EURUSD, and in fact shifted to a relatively good negative correlation last month.

(pay attention if the pair is XXX-USD or USD-XXX so USDJPY -0.86 is good positive correlation with EURUSD meaning both EUR and JPY moved in the same direction against the USD most of the time).

Below 116.90/40 is a good confirmation of a possible continuation down to 113.8 to 112.70 to 110.6 but if you want even better confirmation, break below 115.44 March 1 low will provide it.

Above recent high @ 118.48 and above 119.17 would make me consider 124 as a serious possibility.

Intraday, a most probable correction up to 117.75<>117.87 before any continuation down.

Take care all of you,

ID

Subscribe to:

Posts (Atom)