Nice confluence to USD view gives a look at GOLD chart and the CrudeOil chart.

Gold is about to finish a wave B up around 632.80<>636.45 to continue down to somewhere around 500.00<>437.50 probably 449.20

I expect same with Crude Oil, which could top somewhere around 76.56<>78.13 and correct down to around 50.00

This could be considered US Dollar positive.

idejan

KNOW WHAT OTHERS DON'T

Welcome to my Market Directions ramblings.

I mainly focus on Major Forex pairs.

The idea is to grasp Intermediate to Longer term market moves.

I use different aspects of Technical Analysis and I take into consideration economic news data, but just in conjunction with my technical analysis.

Comments and criticism are welcome as long as they are constructive and will help both readers and me to improve our understanding of markets moves.

Thursday, July 06, 2006

AUD

AUD

if it breaks (very possible) above 0.7460 and 0.7472 it will most probably target 0.7477/7507 to continue down... just broke above 0.7460

let see...

ID

if it breaks (very possible) above 0.7460 and 0.7472 it will most probably target 0.7477/7507 to continue down... just broke above 0.7460

let see...

ID

USDJPY takeoff level

Look for a possible USDJPY takeoff somewhere from around 113.80/50/00

It will need to break below 109 to negate my view, but breaking below 113 would get my attention.

Immediate break above 116 confirms next upper targets.

ID

It will need to break below 109 to negate my view, but breaking below 113 would get my attention.

Immediate break above 116 confirms next upper targets.

ID

Update July 6th, 2006

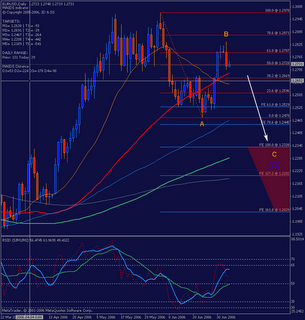

Short update on EURUSD

It is a closer look on what was presented on that picture few days ago.

As I said before, we see a possible ended B, but on the other detail I'm presenting a possible scenario where B is still on...

On the next chart we see that scenario, which I believe is very possible, some more stop hunting before the big dive down in the next C down to finish (A) in the target area shown on the above picture.

However, a significant break below that target area for wave [b] could seriously argue about wave B being fiished, and the break below the bottom of wave A will confirm we are in a wave C down.

Take care,

idejan

Tuesday, July 04, 2006

Short Update

AUD did not made it to lower levels but instead made a retracement right from the levels at the time of the previous post, and right into the posted target area of 0.7400/50 (actual high 0.7458) (see sumary below)

EURUSD

..."If so, then we can expect wave [b] to target 1.2640 to 1.2780 but probably 1.2664<>1.2717 to continue down in a wave [c] to finish first Minor wave A down, probably to 1.22/21 possibly lower to 1.1960/20."...

Finished little above the target area, and now it could be a finished wave [b] as suggested, or it could be just the first wave (a) of that [b], which would mean more sideways to up movement (or more precisely, wave (b) down then wave (c) up to finish [b]).

(see sumary below)

USDJPY

no point updating since I notice that I missed publishing intraday targets for the correction I was forecasting (...I believe that we are about to see a retracement in a wave [b] Minute of the first Minor wave A...)

(see sumary below)

NZDUSD and USDCAD last post still valid nothing to add and I'm sorry I don't have time posting shorter term on this pairs.

Summary

So in general, it is quite possible that recent correction in USD pairs (USD depreciation) could not be finished and could test the previous levels (highs/lows respectively in different pairs), but it would be just what my friend Joseph used to say "a sucker B" which would not travel beyond last tops/bottoms.

See previous picture of EURUSD we are in that unlabeled small red retracement wave [b] up before the next [c] drop down to finish wave (A) (blue).

Hunt this top from the current levels with tight stops, or from little above, than either ride all the way down, or take some profit at the end of wave (A) leave the rest for the ride down, and then add again at the end of wave (B) (again hunt it with tight sl)

There are many considering a 5th wave up, but sorry I can't agree with it. If somebody shows me how can we label that wave 1 (substructure) I would retreat me stand. But I can't even agree with the sub structure of wave 3 being acceptable for labeling it wave 3. I'm talking about the whole move up from Nov low to May high, somebody considering it a possible IM wave up and expecting a continuation in a wave 5.

Best to all,

ID

EURUSD

..."If so, then we can expect wave [b] to target 1.2640 to 1.2780 but probably 1.2664<>1.2717 to continue down in a wave [c] to finish first Minor wave A down, probably to 1.22/21 possibly lower to 1.1960/20."...

Finished little above the target area, and now it could be a finished wave [b] as suggested, or it could be just the first wave (a) of that [b], which would mean more sideways to up movement (or more precisely, wave (b) down then wave (c) up to finish [b]).

(see sumary below)

USDJPY

no point updating since I notice that I missed publishing intraday targets for the correction I was forecasting (...I believe that we are about to see a retracement in a wave [b] Minute of the first Minor wave A...)

(see sumary below)

NZDUSD and USDCAD last post still valid nothing to add and I'm sorry I don't have time posting shorter term on this pairs.

Summary

So in general, it is quite possible that recent correction in USD pairs (USD depreciation) could not be finished and could test the previous levels (highs/lows respectively in different pairs), but it would be just what my friend Joseph used to say "a sucker B" which would not travel beyond last tops/bottoms.

See previous picture of EURUSD we are in that unlabeled small red retracement wave [b] up before the next [c] drop down to finish wave (A) (blue).

Hunt this top from the current levels with tight stops, or from little above, than either ride all the way down, or take some profit at the end of wave (A) leave the rest for the ride down, and then add again at the end of wave (B) (again hunt it with tight sl)

There are many considering a 5th wave up, but sorry I can't agree with it. If somebody shows me how can we label that wave 1 (substructure) I would retreat me stand. But I can't even agree with the sub structure of wave 3 being acceptable for labeling it wave 3. I'm talking about the whole move up from Nov low to May high, somebody considering it a possible IM wave up and expecting a continuation in a wave 5.

Best to all,

ID

Subscribe to:

Comments (Atom)