Joseph & Idejan,

If I can chime in with a couple of thoughts:

Please understand that the Bear is still very much an

amateur trader with a long way to go, but the following is the mindset that has been molded by a couple of a very generous gentlemen guru traders to which I am forever thankful.

In a nut shell when we trade, the best case scenario we can hope for is informed speculation.

Now what makes this different from gambling (where the odds are fixed), we can choose the place, time, method and amount of our wager, if this term applies.

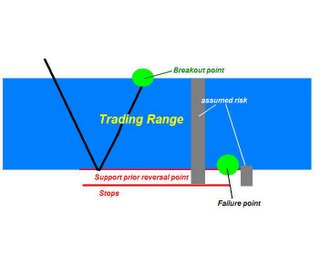

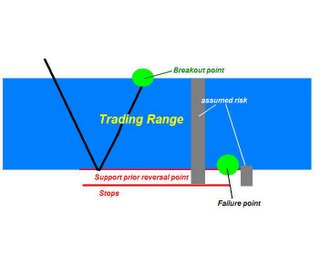

We apply our craft to the charts and choose a game plan that we see offers us the best opportunity for profit. The two sides of the equation we need to measure are potential profit and assumed risk.

All that being said, gets me to the issue of my thoughts.

Eliminating assumed risk and the free ride.Please keep in mind that this is the way I think, everyone’s own trading style is unique to them and fits to their own personality, that’s why it so hard to make trade calls, imo. It’s tough to make a call for a multitude of different traders with different risk and reward tolerances.

You asked me the other day why I felt that it was not the time to go long:

To me the prior potential reversal point provides the support (assuming the view is correct), the farther away I enter from that reversal point the more assumed risk I am accepting, ( because I feel that price can always retest this area and the view remain correct).

When I enter a trade I want to enter:

1) Primarily at what I determine to be the reversal point in advance, the first turn and/or

2) The retest of this point.

At this point my risk is the lowest possible and the time it takes for me to be out of risk is the lowest also. ??????????

Eliminating assumed risk.

From this reversal point as price moves away I will quickly cash in a portion of my position and snug my stops to just below the low, preferably to a breakeven + profit position. At this point I have pocketed some pips and the remainder of my position is a free ride to continue to the next turn and we start the process all over again, if my view is incorrect and I get stopped out I still make money. Which is what this game is all about,

making money - not necessarily

being right.

If I cannot enter at or very near the turn I will not take the trade, I want price to come to me and not the other way around.

From your chart the other day on the long term Yen price had moved north to the resistance/downward sloping trend lines. This would be a point to trade south imo. North positions would be establish after either price had reversed off these lines or price has broken thru and retested the line. To enter now would leave yourself very vulnerable both price and time wise, to the extent that you trade could become profitable with protected stops.

In a nut shell we want to enter at a point that offers us the least amount of risk and time to get ourselves in a profitable position.

Sorry to ramble, hope this makes some sense.

Bear