AUDUSD

It topped an hour after I posted. We still need a confirmation for the previously posted targets 0.7208 and below 0.7060/10 to 0.6860 Second leg is still forming (H4 chart the drop was first leg...) and it's not finished yet (meaning a possible one more move up before a continuation down) Next Minute move down would target a min of 0.7420 but more probably lower 0.7332/24...

NZDUSD

Right in the published target box. It entered into the box, lower band of the box, not sure it's over yet. We still need more clues for the longer term picture to unfold.

*GOLD* and *CrudeOil* I'm very confident it topped and we are about to see a significant decline (to 500 and below). Same for the CrudeOil (probably 50).

ID

PS. I wrote and sent this by mail to my blog around 16.30 and it is still not published. this was the first time I'm trying posting by mail. The first update (previous post) had few minutes delay (around 10min) but the second is now an hour late and still not even arrived.

That's why I've decided to post my update directly here while it could still be relevant since it is intraday comment :)

So mind that it was writen an hour before the time of the stamp here and if by any chance another copy of it appears later that means that my mail finaly arrived :)

I'll check later.

KNOW WHAT OTHERS DON'T

Welcome to my Market Directions ramblings.

I mainly focus on Major Forex pairs.

The idea is to grasp Intermediate to Longer term market moves.

I use different aspects of Technical Analysis and I take into consideration economic news data, but just in conjunction with my technical analysis.

Comments and criticism are welcome as long as they are constructive and will help both readers and me to improve our understanding of markets moves.

Tuesday, July 18, 2006

18 July Update

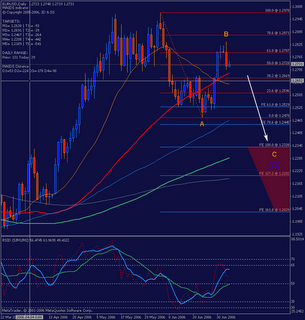

EURUSD

Bounced just above 1.2485

If this low (1.2495) holds, then first target up is 1.2580 to continue to 1.2665/78 to 1.2720. Break above that to retest 1.286 to 1.2893

I don't expect it to be a nice IM sharp move up, but rather it will be slow sideways to up move.

USDJPY

(last update 6 July)

nice takeoff from that last update and right from the expected levels for a ~370 pips move.

Now a break below 116.65 would be a good indication for a retrace to a 115.63/32 and a break below that would be a good for 114.10<>113.70

But... Looking at the pattern of this recent rely, I suspect of a possible one more move up to finish it. Possibly not higher than 117.6, I was expecting 117.30/35. If higher than 117.6 then possibly 118.4

ID

(other pairs to follow in a while.

press CTRL+F5 for to refresh your browser.)

Bounced just above 1.2485

If this low (1.2495) holds, then first target up is 1.2580 to continue to 1.2665/78 to 1.2720. Break above that to retest 1.286 to 1.2893

I don't expect it to be a nice IM sharp move up, but rather it will be slow sideways to up move.

USDJPY

(last update 6 July)

nice takeoff from that last update and right from the expected levels for a ~370 pips move.

Now a break below 116.65 would be a good indication for a retrace to a 115.63/32 and a break below that would be a good for 114.10<>113.70

But... Looking at the pattern of this recent rely, I suspect of a possible one more move up to finish it. Possibly not higher than 117.6, I was expecting 117.30/35. If higher than 117.6 then possibly 118.4

ID

(other pairs to follow in a while.

press CTRL+F5 for to refresh your browser.)

Monday, July 17, 2006

17 July update

EURUSD

Way below the expected target area, and although it could still be a valid count, the alternative gray count seems to be unfolding, which as I mentioned in fxs thread on MTec, would mean continued sideways trading in wave B, before we can expect a drop down to 1.22 and below...

Since this drop went this deep, it provides a wider range for the next move up below the 1.298 top.

Intermediate bias is still bearish, but I expect this drop to end soon, probably not below 1.2485, to bounce up to 1.2750 and probably not higher then 1.2897, but we should wait the market to develop some indications before we can project possible targets up.

ID

Way below the expected target area, and although it could still be a valid count, the alternative gray count seems to be unfolding, which as I mentioned in fxs thread on MTec, would mean continued sideways trading in wave B, before we can expect a drop down to 1.22 and below...

Since this drop went this deep, it provides a wider range for the next move up below the 1.298 top.

Intermediate bias is still bearish, but I expect this drop to end soon, probably not below 1.2485, to bounce up to 1.2750 and probably not higher then 1.2897, but we should wait the market to develop some indications before we can project possible targets up.

ID

Tuesday, July 11, 2006

NZDUSD update

NZDUSD

last post on this pair was accurate call for a bottom, and turned to be a good buy call (~0.5960/50) for ~200 pips at current market price (0.6167).

Now watch 0.6198<>0.6233 for a possible retrace, but I would expect it to possibly go up to 0.6269<>0.6336

Still no clear answers to those questions. we need to let the market develop more clues, before we can have the answers.

I'm still not really convinced we have a bottom...

I'll try preparing more detailed analysis during the weekend.

I also consider continuing my video analysis series.

ID

last post on this pair was accurate call for a bottom, and turned to be a good buy call (~0.5960/50) for ~200 pips at current market price (0.6167).

Now watch 0.6198<>0.6233 for a possible retrace, but I would expect it to possibly go up to 0.6269<>0.6336

Still no clear answers to those questions. we need to let the market develop more clues, before we can have the answers.

I'm still not really convinced we have a bottom...

I'll try preparing more detailed analysis during the weekend.

I also consider continuing my video analysis series.

ID

AUDUSD daily update

AUDUSD topping, but it could go up to 0.7573<>0.7592

Depending on your strategy you could short from here and add if it goes higher with stop above 0.7592 or hunt the top from here with tight stops.

If this plays true, min target 0.7208

next targets 0.7060/10 to 0.6860 (most probable min target to finish larger correction). Below that 0.66

Nice confluence with Gold, which was contained in my target area for a while but broke above it today. That made me reconsider a possible break little higher on AUD too. Nevertheless it is either a top or very close to a top, which represents a nice R/R opportunity.

This is a great Risk to Reward opportunity.

Take care

idejan

Depending on your strategy you could short from here and add if it goes higher with stop above 0.7592 or hunt the top from here with tight stops.

If this plays true, min target 0.7208

next targets 0.7060/10 to 0.6860 (most probable min target to finish larger correction). Below that 0.66

Nice confluence with Gold, which was contained in my target area for a while but broke above it today. That made me reconsider a possible break little higher on AUD too. Nevertheless it is either a top or very close to a top, which represents a nice R/R opportunity.

This is a great Risk to Reward opportunity.

Take care

idejan

Monday, July 10, 2006

EURUSD update

On the chart is the update of the previously published chart.

On the chart is the update of the previously published chart.It shows a possible Running Flat (wave [b]), and if the recent fall wave (c) continues lower of (a) it will be an Extended Flat. Of course break below 1.2478 will confirm C down... On the other side, break above 1.2980 will invalidate this scenario.

Best to all

ID

Thursday, July 06, 2006

Gold and Crude

Nice confluence to USD view gives a look at GOLD chart and the CrudeOil chart.

Gold is about to finish a wave B up around 632.80<>636.45 to continue down to somewhere around 500.00<>437.50 probably 449.20

I expect same with Crude Oil, which could top somewhere around 76.56<>78.13 and correct down to around 50.00

This could be considered US Dollar positive.

idejan

Gold is about to finish a wave B up around 632.80<>636.45 to continue down to somewhere around 500.00<>437.50 probably 449.20

I expect same with Crude Oil, which could top somewhere around 76.56<>78.13 and correct down to around 50.00

This could be considered US Dollar positive.

idejan

AUD

AUD

if it breaks (very possible) above 0.7460 and 0.7472 it will most probably target 0.7477/7507 to continue down... just broke above 0.7460

let see...

ID

if it breaks (very possible) above 0.7460 and 0.7472 it will most probably target 0.7477/7507 to continue down... just broke above 0.7460

let see...

ID

USDJPY takeoff level

Look for a possible USDJPY takeoff somewhere from around 113.80/50/00

It will need to break below 109 to negate my view, but breaking below 113 would get my attention.

Immediate break above 116 confirms next upper targets.

ID

It will need to break below 109 to negate my view, but breaking below 113 would get my attention.

Immediate break above 116 confirms next upper targets.

ID

Update July 6th, 2006

Short update on EURUSD

It is a closer look on what was presented on that picture few days ago.

As I said before, we see a possible ended B, but on the other detail I'm presenting a possible scenario where B is still on...

On the next chart we see that scenario, which I believe is very possible, some more stop hunting before the big dive down in the next C down to finish (A) in the target area shown on the above picture.

However, a significant break below that target area for wave [b] could seriously argue about wave B being fiished, and the break below the bottom of wave A will confirm we are in a wave C down.

Take care,

idejan

Subscribe to:

Posts (Atom)