As you can see, while the DJIA (blue line) made new high at the beginning of 2007 the adjusted Dow (red line) never made it so high.

Based on the adjusted DJIA chart, it is quite possible that we are living the last leg of the larger correction that started 2000.

:)

Just to cheer you up.

There are some other indications supporting this view. IMHO we need to wait for just a few months more to see the developing.

On my charts from few days ago, you'll see I forecast DJI to go up to 10,200 (it's not actually shown but it can be seen based on the fib ext tool points...) before it dips possibly to end this correction down to 6840<>6550<>6040.

Few months ago I said I expect Dow Jones US Home Construction Index to end it's fall, and it now shows some indication of a possible reversal. This supports previously said, but it will take time to be confirmed. (.DJUSHB on Google Finance you can see a possible IM - Impulsive wave 1 up finished....)

I was doing some analysis on few Forex pairs, but still far from being in shape. I mainly look for short term moves, still trying to grasp the bigger picture.

(still considering few options for my future posts

As you can see, while the DJIA (blue line) made new high at the beginning of 2007 the adjusted Dow (red line) never made it so high.

Based on the adjusted DJIA chart, it is quite possible that we are living the last leg of the larger correction that started 2000.

:)

Just to cheer you up.

There are some other indications supporting this view. IMHO we need to wait for just a few months more to see the developing.

On my charts from few days ago, you'll see I forecast DJI to go up to 10,200 (it's not actually shown but it can be seen based on the fib ext tool points...) before it dips possibly to end this correction down to 6840<>6550<>6040.

Few months ago I said I expect Dow Jones US Home Construction Index to end it's fall, and it now shows some indication of a possible reversal. This supports previously said, but it will take time to be confirmed. (.DJUSHB on Google Finance you can see a possible IM - Impulsive wave 1 up finished....)

I was doing some analysis on few Forex pairs, but still far from being in shape. I mainly look for short term moves, still trying to grasp the bigger picture.

(still considering few options for my future posts

KNOW WHAT OTHERS DON'T

Welcome to my Market Directions ramblings.

I mainly focus on Major Forex pairs.

The idea is to grasp Intermediate to Longer term market moves.

I use different aspects of Technical Analysis and I take into consideration economic news data, but just in conjunction with my technical analysis.

Comments and criticism are welcome as long as they are constructive and will help both readers and me to improve our understanding of markets moves.

Sunday, January 04, 2009

End of THE Recession?

As you can see, while the DJIA (blue line) made new high at the beginning of 2007 the adjusted Dow (red line) never made it so high.

Based on the adjusted DJIA chart, it is quite possible that we are living the last leg of the larger correction that started 2000.

:)

Just to cheer you up.

There are some other indications supporting this view. IMHO we need to wait for just a few months more to see the developing.

On my charts from few days ago, you'll see I forecast DJI to go up to 10,200 (it's not actually shown but it can be seen based on the fib ext tool points...) before it dips possibly to end this correction down to 6840<>6550<>6040.

Few months ago I said I expect Dow Jones US Home Construction Index to end it's fall, and it now shows some indication of a possible reversal. This supports previously said, but it will take time to be confirmed. (.DJUSHB on Google Finance you can see a possible IM - Impulsive wave 1 up finished....)

I was doing some analysis on few Forex pairs, but still far from being in shape. I mainly look for short term moves, still trying to grasp the bigger picture.

(still considering few options for my future posts

As you can see, while the DJIA (blue line) made new high at the beginning of 2007 the adjusted Dow (red line) never made it so high.

Based on the adjusted DJIA chart, it is quite possible that we are living the last leg of the larger correction that started 2000.

:)

Just to cheer you up.

There are some other indications supporting this view. IMHO we need to wait for just a few months more to see the developing.

On my charts from few days ago, you'll see I forecast DJI to go up to 10,200 (it's not actually shown but it can be seen based on the fib ext tool points...) before it dips possibly to end this correction down to 6840<>6550<>6040.

Few months ago I said I expect Dow Jones US Home Construction Index to end it's fall, and it now shows some indication of a possible reversal. This supports previously said, but it will take time to be confirmed. (.DJUSHB on Google Finance you can see a possible IM - Impulsive wave 1 up finished....)

I was doing some analysis on few Forex pairs, but still far from being in shape. I mainly look for short term moves, still trying to grasp the bigger picture.

(still considering few options for my future posts

Sunday, October 07, 2007

Well I wanted to preserve some of my first writings I published at MoneyTec forum in my first thread opened there called My Elliott Wave Charts.

Somehow I find it more safe here than in my computer :)Any way I only recently copied my posts with ease, keeping the original formating, thanks to Google Notebook.

Here are my posts from mid 2005.

Very best to all

idejan

PS. At the time I wrote those posts below, I was not very familiar with Iris's work and consequently, with his understanding of Fundamentals.

Anyway, although I later understood what he means by Fundamentals (He practices Gann among other methods)(and not that I agree with him even now anyway), I am grateful that I was inspired with his awkward stile of writing to write this ramblings on the psychology and forces behind Markets.

So thanks to Iris and his MoneyTec thread and also thanks to Noor, who always stood there to defend Iris...

ID Elliott Wave & Forex Writings

My Elliott Wave Charts Thread

My Elliott Wave Charts - Page 2 - MoneyTec Traders Community ForumRecently I've published a post disagreeing with Iris and what he said about the Fundamentals -

| Originally Posted by Iris "...expectations do not set Long Term Price levels...Fundamentals do..." |

But since it is an interesting subject (fundamentals) I've decided to paste my previous post from Iris's thread here, with a little follow up example.

| Originally Posted by idejan Hi Iris, Although I admire your work very much, I could not agree on this with you. Actually what you read (fundamentals) today, usually is a report for a period of at least one month before. What happened that month is a consequence of something that occurred 3-6 months before (if not more)... Expectations (desires, hopes, dreams beliefs etc. - the social mood) produces behavior which produces results (measured with - fundamentals). How can possibly someone explain why on stellar good reports dollar did not react (or did negatively) and opposite on that we've seen huge moves on weak and bad data? (and not only $US) You've all probably heard before a one word explanation - HERD, CROWD. MASSES... What I agree with you is that we are on a juncture (which I believe is to be a bit higher @ 1.2450/95) to go south to 1.2297/63 (my time projection was 5-9 but few days more would be acceptable for me) . *(thanks to Iris I've started learning more about time) Best to all and don't give any PIPs back, ID |

If however we were in a bar, and you'd ask me which one of the two girls sitting at the other side of the bar I'd prefer, the blond or the brunette, (I'd most probably said both, but) I'd said I prefer blond. On the other hand if I was to give you a rational answer, I'd probably said that I'd consider face, body, length of their legs... and other attributes

Oops, I did not mentioned some fundamentals like intelligence... it's definitely the beer.

ID

*but then again it's only me being impressed with social phenomenas...

and only if people were rational beings...

My Elliott Wave Charts - Page 2 - MoneyTec Traders Community Forum

Hi everybody,

Inspired with the latest posts in one of my favorite threads, Trading Eur/Usd with uncle Elliot, I decided to post my opinion on something I've mentioned in my previous posts, and that's my opinion about trading Elliott Waves on different time frames.

Part of what I've posted in mentioned post was:

| Originally Posted by idejan The best advice I can give is that Elliott doesn't works that good on small time frames and for scalping. (it works but it requires a great great experience, and if you could do it people will probably call you NEO |

If you are too close to, or in the crowd, you could not possibly see the crowd, how it behaves and which direction it goes. You will see those near you, their moves, emotions etc.

E.g. From the view point of an antelope there is no particular direction where it's heading when it starts running, since it follows the first next to it. It doesn't even knows why's doing that at the moment, or if it's wise thing to do. But it is not really important how wise it is, since their primal part of the brain sends an impulse which says "preserve". Preserve life. Their trail is zig zag and seem quite confused (doesn't those moves on a 1 min charts on important announcements seem similar?).

But if you pull out and lift your camera above the herd, you are starting to get some direction. And going even further above you don't see all those small zz all those antelopes in the herd are doing, but you'll see the HERD going in some pointed direction.

Traders primal instinct says preserve too. They need to preserve their money.

Isn't that an example.

But in fact, it is a good example.

So, it is my humble opinion that EW works best on Daily charts, since it filters all those small moves, using Hourly for checking sub-waves and determining the confirmation - invalidation levels (S/L below invalidation).

ID

My Elliott Wave Charts - Page 3 - MoneyTec Traders Community Forum

and here it is accompanied with the additional comments:

| Originally Posted by idejan Originally Posted by Iris Hello Noor and Everyone....... ... The Markets Price expectation will always revert back to the Fundamental of Time...today's a good example ... __________ Yes I agree, it will eventually. But the thing is, that while forecasting markets gives a room and comfort of being wrong until it does (price reverts), trading markets doesn't. If ones stops are being hit every day for a time period of a day(s), week(s), month(s), chances of one being drawn down, grows with his/hers continuing "expectation" that the Price will at some point "revert back to the Fundamentals of Time". So, it could always prove that ones anticipation should revert back to the Fundamentals of Time, rather than waiting the Price to do that. Especially if Time and Price are correlated and in a some kind of an agreement _______________ Originally Posted by Iris Time has Curvo-Linear Wave properties...and they do repeat...Price is a mathmatical numeric that exists within and must conform to the structure of Time because they operate within the same constants and variables _______________ than it could be that they never disagree (diverge), but it's our expectations about the Fundamentals, that are in a disagreement (both with time and price). _______________ Originally Posted by Iris ... In regards to disparities between them or "Fog" the Markets Price expectation will always revert back to the Fundamentals of Time calculated thru the Technical of Price...for that is how a Trend continues or reverses course to its true value... _______________ And to the point. Markets Price expectation will never revert back to the Fundamentals of Time, since the PRICE is THE EXPECTATION(S). It is the Aggregate Expectation and Agreement of the MASS (even those not trading, since their expectations influence Fundamentals etc.) Market Price expectations, the PRICE, will never revert back to the "Fundamentals of Time", since it is ahead of them in time. Ultimately it is the Fundamentals that will at some point of time show up to reflect the results of the ACCUMULATED EXPECTATIONS or "Social Tendencies - Behavior". As for the ______________ Originally Posted by Iris ...today's a good example ... ______________ The price before the announcement was trading in a range from 1.2449 to 1.2485 (36 pips) and just before the announcement was somewhere @ about 1.2465 HIGH. In the next 30 minutes, it fell down to 1.2381 LOW (84 pips) to get to 1.2445 (64 PIPs or 76% of previous move) in the next 5 and a half hours. Previous trading day low was around 1.2375 and high at 1.2475 (100 Pips) with a closing just a few pips below the previous high. The Average day move for EURUSD I believe is to be 110-120 PIPs. Sorry, I could not give a significance to something that insignificant as Friday's "Markets Price expectation reverting back to the Fundamental of Time". I've started an explanation of the terms Fundamentals and Expectations here, since they are the key in this post (and many others), but decided to move it to my post, for one to keep this post simple (if that was possible at all You can find it Charting & Technical Analyst under My Elliot Waves Charts Best to all, ID Important NOTE: I'm not following Iris calls and I don't imply this to his calls, even that it just seem to me he was wrong on EURUSD for same time. I don't have a record of that and it is not the point here to prove that he is wrong. This is just my humble opinion and a different view on some of the Market essentials. |

Here is that part on The terms Fundamentals and Expectations:

I'm getting very annoyed with the implied meaning to the "Fundamentals" as being THE FUNDAMENTALS. Economic indicators are just a numeric representation (and not accurate but more of a trial representations) to RESULTS in the ECONOMY which it self is a one of the pillars of the society, since trough the "actions" of man in the "economy" he can fulfill one of it's FUNDAMENTAL NEEDS (the need for material necessities - food, cloths etc for himself and his family - or Economic security and safety). So the indicators are not FUNDAMENTALS.

As for the EXPECTATIONS, I've used them just because of the relation to the previous posts, and they are in fact (dreams, hopes, desires etc.)

One have NEEDS, then one Dreams, Hopes, Desire about fulfilling those NEEDS. These are the essence of the MOTIVATION. However the innate capacity to do or be (ABILITY) determines if the one will take some ACTION to fulfill his DREAMS, HOPES (explanation: while dreams are unlimited expectations full of "what ifs", Hopes require a "desired expectation" or the expectation that something will happen if nothing goes wrong) and DESIRES (explanation: the awareness that something better exists). It is the convergence/divergence of the DREAMS, HOPES, DESIRES vs ABILITY that creates HAPPINES or FRUSTRATIONS.

The simple fact is that all animals including humans, primal NEED is to SURVIVE, to continue to live. To do that they need to take actions. Trading Markets is one of the ACTIONS people trade to profit in money, to be able to fulfill their Dreams, Hopes, Desires - related to their NEEDS. It is how GREED could manifest it self in the trading. On the other side is the FEAR (of loss). It is a manifestation of the FEAR concerning ones Economic security and safety, connected with the PRIMAL INSTICT to SURVIVE (continue to live, preserve life) and it is why the FEAR is so sincere and strong emotion.

NOTE: I'm not a psychologist.

Last edited by idejan : 13-08-2005 at 21:09. Reason: Quotation inside quotation were not shown in my post.

My Elliott Wave Charts - Page 3 - MoneyTec Traders Community Forum

In my previous posts I have started writing on something I believe to be essential, and even that at this point it may seem confusing how it relates to Trading Markets, I'll hopefully come to that at the end.

I have previously talked about Needs, Dreams-Hopes-Desires (I'll use the word Expectations for simplicity from now on), Abilities, Actions and Results. And it seem like a one way road.

And to the some point it is.

But first let me try to recap and then continue.

All human have same fundamental NEEDS, but develop different Dreams, Hopes, Desires (Expectations) by the surge to satisfy their NEEDS. To satisfy those Needs man should obviously do something, ie - take Action(s). Expectations are the MOTIVATION (the fuel) necessary for one to take ACTIONS.

Now, For the purpose of performing Actions, we would need to develop or adopt a certain method, or general set of tools and guidelines suitable for that Action(s). Our innate potentials, to accomplish either what is physical or mental, those row latent capacities or abilities, talent, physical ability, intellectual and emotional aptitude, ie SKILLS, determine the APPROACH(es) we develop. On a higher level APPROACH determines if on is a BE-ER or a DO-ER or if his general approach to problem solving is to adopt him self to the situation or environment or to adopt the environment to himself.

And we now enter the real world and start to practice our Actions with our Ability using our Approach, driven by Expectations derived from our Needs.

So we act and interact with others (their actions) both mental and physical.

The cumulative effect of that action and interaction in observing and/or participating in mental and physical activities until they become familiar represents our EXPERIENCE. And that's how our Ability get's it's practical component. But just because those activities become a second nature, does not mean we are necessarily good at them. It is the innate Skills and the Experience together, that determine the our real ABILITIES. So every day aggregate activities (actions, interactions) are the building bricks of men's Experience determining that way his REAL ABILITIES.

So what that cumulative effect, ie Experience, really does is making us constantly evaluate and redevelop or adopt our Approach. The side effect of that process is that when ever we feel we are not able or feel being able for more, we also evaluate and redefine our Expectations. If we feel ABLE then our Expectations grow and opposite. If how ever our real Abilities luck of either Skills or Experience we could easily end frustrated, since our Ability could not fulfill our Expectations.

So driven by our expectations to satisfy our needs we develop Approach and start practicing our actions, by what we interact with other people (practicing their actions too), we build up an Experience, which then helped in determine our Real Abilities by adding a practical side to our innate Skills, and also made us constantly evaluate our Approach and Expectations.

To make it simple in a way if our Experience says we CAN and we than say GO, and if it says we can't we say STOP.

In that combined effort of our Skills and Experience in the pursuit of our expectations, as I've said before, we are not necessarily good at what we do. So we experience both Pleasure of success and Disappointment of failure on our pursuit of Happiness. It is how accumulated interactions, help developing ATTITUDE.

Attitude is the manner in which we proceed with our Approach. We may be hard driven, cool, assertive, but in general we could have a positive or negative attitude.

And here we are to the point were we can say that:

It is the Cumulative manor (Attitude) with which we all proceed with our developed and adopted methodology of doing and being (Approach) in our Constant pursuit of fulfilling our Expectations which derive from our Needs, that creates the Social Trends and Tendencies (General Sentiment).

That is the place where the Wave Principle comes in.

Since there are number of sources on the Wave Principle, I will not go into explaining what has already been explained by people with much more knowledge and understanding of the Wave Principle, but in some of my next posts, I will try to make some practical observation about trading it.

I've tried to give as possible simple explanation of very simple and intrinsic issues, but it seems that the most simple things take more time to explain, as for to me an unknown reason people do not accept simplicity. It seems to me that most probable reason for that however could prove to be the constant need of men to be Clever, and like simplicity insults cleverness. It is probably there where our constant need to complicate an obviously simple things derives. At least it's how it appears to be.

ID

Last edited by idejan : 14-08-2005 at 23:18. Reason: typo

My Elliott Wave Charts - Page 3 - MoneyTec Traders Community Forum

So here is post as a continuation of previous and as an answer to Noor, who showed very constructive approach and with that I believe is a person who is willing to share his knowledge and experience.

(read his post @ Sell EUR/USD in Daily trade recommendation)

_______________

Hi Noor

My post is nothing more then a presentation of a different view on the forces behind the market, so I highly appreciate your constructive effort...

I'd like to add something to your explanation about divergence.

di•verge (also di-) -verged', -verg'ing, -vergence

- to go or move in different directions from a common point or from each other; branch off [paths

that diverge] (Webster)

But what's behind.

If you PUSH something it will always go in the direction opposite of the PUSH and as other forces

start to involve it will drift away of the path. The PUSH is divergent. On the other side, if you

PULL something (attach a string and pull) no matter how other forces influence the object in other

directions, it will always be going in your direction, more and more directly. So, PULL is

Convergent.

This are the two always co-existing fundamentals of the Universe (Push-Pull, Repulsion-Attraction).

The indicators that you've mentioned (for the simplicity, lets say) are trying to measure that.

(RSI and Stochastic (and Momentum) are Most known Oscillators and Moving Average Convergence

Divergence or MACD is a A trend-following momentum indicator and it could also be added to

oscillators group of indicators. This is a very simplified explanation and you should all find a

very good explanations on different market indicators at Investopedia).

As for the evidence on my view... But first congratulation to Iris on his work approaching 2000

posts. I was not aware that he has developed his own Price/Time theory. I admit I'm not very familiar with his work.

I've seen he is giving

signals in his thread and somehow assumed that that's it, that there is no explanation on how he

came up with those numbers. Never went through the posts from the beginning.

I don't know if you've read the addition published in my thread, since I believe it provides some

explanation on my view, and I'm not sure what will be a good evidence, to prove that view.

Personally I did not post anything here to prove something, but to present a different view. While

the concept of Driving a car is proven, different people will drive a car differently (producing

different results in a race for an example) and some will not even be able to drive. Even the

simplest task given to different people will create different results. It's why Forecasting Market

and Trading that Forecasts is very different thing, and above all different traders will have

different results with following same forecasts.

I don't however believe that anyone on this planet, no matter how genius, could possibly

comprehend all those incomprehensible number of inter-actions of continuous pulls and discontinues

pushes happening every single moment around the planet that influence every single aspect of our

life. It is why this is a game of Probabilities and not certainty.

All human have same fundamental NEEDS, but develop different Dreams, Hopes, Desires by the surge to

satisfy their NEEDS. Expectations are the MOTIVATION (the fuel) necessary for one to take ACTIONS,

and they all take different actions (since they all have different approach, or if they share the

same approach they all have different attitudes) to fulfill their Dreams, Hopes, Desires

(expectations).

It depends mostly on the fuel how far one will reach in fulfilling his expectations. ACTIONS then

produce RESULTS that are the reflection of those Expectations. It depends on the MOTIVATION and the

ABILITY how close to EXPECTATIONS are this reflections, or the RESULTS. It's something I always

argue with people, that it's not really important what you think and what you feel (relative to

others), since what you do, your actions are the real reflection of what you are. You will very

often be fooling your self how much you want something, but you should very easily measure "how

much" with looking at your actions, or what you do toward that wants.

It's now know that Activity and not Material particles are the basics of the Universe.

As for the view on the market and it's direction, I've covered that in detail in my posts so

there's no need to repeat my self here.

It is getting late, so hopefully we will be able to continue exchanging knowledge and experience in

our combined effort to take profit from the Market. I am very grateful to your constructive

approach, since I believe that there is always something new to learn. Helping others to learn,

helps you to learn even more.

Best to all,

ID

Last edited by idejan : 14-08-2005 at 02:58. Reason: typo

My Elliott Wave Charts - Page 4 - MoneyTec Traders Community Forum

But then the majority of people who practice Wave Principle are trying to use it mechanically.

_______________________

And now for what I think is important about implementing Wave Principle.

In previous posts I've tried to point the fact that it is the Actions that move the world, but that it's our attitude (positive or negative) that greatly influences that actions and with so the results of that Activities.

It is the General Social Mood that determines the performances of the Society and it's Economy as a part.

The Wave Principle is exactly about that. Social, or Crowd behavior moves up and down (from positive to negative) in recognizable patterns. It is from this discovery that the market analysis method was developed now know as Elliott Wave Principle.

How good will someone use it, depends on learning the patterns of crowd behavior. By anticipating the crowd, he will be able to avoid becoming a part of it.

And while a careful reader reads: learning THE PATTERNS OF CROWD BEHAVIOR, most of the traders read: LEARN TO RECOGNIZE and LABEL WAVE PATTERNS.

Although it seems that those two are the same thing, it isn't. The difference is not in the method.

While the first will try to reveal the NATURE of the waves, and with that, the real forces behind the scene, the other, will try to recognize the geometry of the forming patterns and label them, obeying the rules and guidelines. That's a mechanical approach and has nothing to do with the Wave Principle.

It hasn't because of the simple fact that the human behavior, although moving in recognizable patterns which obey certain mathematical relations, which are represented by the correlations of PRICE (the indicator of the behavior) and TIME, is not a predetermined neither by Time or Price.

IT DOES NOT REPEAT and could change. It is called evolution. We all change, and we influence others to change, same as they influence us. Our mental, emotional and physical "support and resistance" lines change every single day (every second). We are dynamic system and an organic one, not a mechanical.

The wave Principle can prove good in determing the Most probable market direction and is briliant since you could also determine the CHANGE in the Behavior. It gives you a direction. Not a trading signals. Changes in behavior take time. People don't lose faith and positive attitude suddenly as they do not recover from pesimism by night. That's why it is very important to know how to recognize the nature of the patterns on your chart. And it is a different psychology on a different time frame. It's like wondering arround the streets and looking from the top of the hill.

_______________________

What wave Principle uses is the PRICE, where the PRICE it self is an INDICATOR of the agregate Social Behavior and MOOD. SO PRICE it self IS A MEASURE of SOMETHING and NOT a subject of measurement it self. (it could be but it's irrelevant to this) Wave Principle is about knowing the true Nature of the Waves, or what's beneath. The price is a matterial reflection of the Social Behavior, so what the geometry of price/time tries to reveal is not PRICE in TIME, but where the Social Behavior is and Where it is heading.

Would I be able to assess my possible future earnings (Price) by simply looking at my previous historical earnings, or by looking in my readiness, my mental, emotional and physical fitness to cope with LIFE, recognizing my true "expectations", using my real abilities and finding the best possible way fullfiling them (my behavior) all at right time?

_______________________

Let's imagine that we are about to go on a holliday. We live in a city "A" and we are to go to Place "B" by car.

We get a road map and the first thing we do is try to find where we are on the map and then where the place B is, we draw a straight line connecting this two points. Now by just a simple look on the map we instantly have a clear picture of where we are and where we would get eventualy. By observing the map more carfuly (Analysing) we start drawing the path we will go trough. While we easily drown a straith line connecting those two points on the map (chart) now we recognize that we will have to travel somewhat different path which will include a lot of straight lines (trends) and quite a few turns (corrections). We will most certainly need to get out to other main roads that somehow are not going in our direction (larger corrections/reversals) just to get to the point where we will get to our road which will lead as to the place B.

Well what we have here is an expectation (to have a vacation), which induced an action (we started preparation and hopefully got there) for which we developed a plan (approach) an adopted already proven plans (car transportation, road map for directions etc). So eventualy we pack our bags and start the journey. We have anticipated the path, approximate time of arrival based on speed etc, and some other important elements of the journey with our analysis, we printed a perfect plan and we now only have to drive from point A to point B to get there.

Let us now assume that the plan is so perfect that it includes all the possible turns, pointed within milimeter with GPS, an includes all the ralationships of speed and distances.

Now could you drive your car to the destination by simply looking at the speedometer following speed (price) and distance (time) and following that perfect map (on GPS)? Not even if the roads where empty. The weather, people in the car- your company, the car you drive, the man at the gas station and milion other things you could've never possibly dream and yet to anticipate. And even you. Your abilities (physical, mental etc.) are not a matematical constant that can easily be predicted and calculated. Or are you?

So even with having a clear recognized pattern of behavior and a perfect plan (we recognized we are heading from point A to point B and recognized the pattern which we will travel developed a perfect radmap) and with so many people already driven the same path over and over again, you could not drive eyes shot. There's always something that could change your plan. Something always does.

Thank you for bearing with me all this way, and I apologize being so boring.

But only if humans were a rational beings.

Best to all,

Dejan

Sunday, September 24, 2006

Market Update

Here is just a small part of my notes I write for my own reference.

Pictures are bit compressed but they are clear and readable.

This are continuation of previous weeks notes from the Google group I've mentioned few post back, which will be available for a while before I delete them.

You will also find notes on 16 more pairs. I publish them by mail directly from the charting program and it's a life saving option.

This Blog somehow does not accept the same mails and it complicates the whole thing.

While I don't mind sharing my notes and thoughts, I'm still not very sure if it is useful to anybody.

Any way, until I find a solution that will save me time preparing and publishing my notes, I'll try keeping this blog live with at least few views published once a week over the weekend.

Thank you for your mails and interest in my analysis, and I hope to be able to spend more time answering all of your questions.

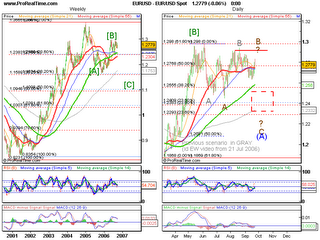

EURUSD

I mentioned last week that I don't quite like what I see on the chart, so I reconsidered my view.

I made a slightly different count from the one in the last video analysis I published, hm when was that, 21 July, quite some time. Any way here it how I see.

So, I have two possible target areas on the upside to finish that B on the Daily if not finished at Friday daily bar high. On a break of 1.2831 last Daily bar high, first up is 1.2872/77 and second is close to the previous top 1.2926/37/48.

Break down below 1.2725 to ease the upward pressure and below 1.2632 to confirm possible C of (A) down.

And here is the Hourly chart for more detail.

I personally think it is a top, but caution is needed.

idejan

USDJPY

It is on target (see prev. post and for more targets too) but could end little lower, probably 115.84/53 to continue up...

idejan

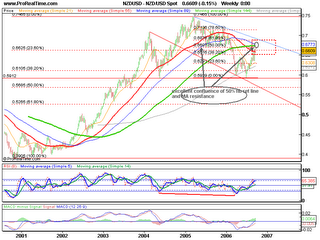

NZDUSD

Intraday probably lower to 0.654<>0.65

There are slightly different scenarios (EW counts) than the one on the chart in which we could have a Minute or Minor top.

If so than the correction could go lower than 0.65, to possibly 0.63.

I still think it will finish little higher before it makes the second wave 2 or B. (see next chart weekly)

idejan

Here is the weekly chart and that nice confluence of Fib 50% Retracement line and MA resistance

AUDUSD

It made high 0.7580 and still above the green MA. (also see weekly)

(prev. bar on the weekly low @ 0.7483; red MA @ 0.7482 green @ 0.7490 and last bar low @ 0.7494, red @ 0.7479 green 0.7491).

This is the support needed to break to confirm down targets. First most probable target down is 0.7279/70 to continue down to 0.7 and below to 0.6792/81/72 targets...

idejan

Thursday, September 14, 2006

My On line Notes

it's been a while since my last post.

I got an answer from google team that I won't be able to have my Analysis organized in topics at my Google group if I publish them by sending them by mail, as I do now directly from the charting program (nice feature in ProRealTime charts).

Since I don't have time preparing first and then posting them later with a reply (which is the only way they can be organized in topics), I decided to delete the group I've been using as my on line notebook. No use of it if it's not organized and easy to followup.

I downloaded all my notes, so now I'm making it available to you before I delete it. If it can be of any use to you at all. Not really educational and calls are mostly expired or about to expire...

http://groups.google.com/group/waveid

idejan

Tuesday, August 22, 2006

Thursday, August 17, 2006

EWT Ramblings with Bear

I've read your conversation with modi on FXS thread the other day and I won't say if he is right or wrong, or how good is his approach, but instead, with the things he says, question arises if he speaks about EWT or rather to some new approach?! That is simply because from that little I've read and from seeing his counts, it seems that he (they) changed some of the fundamental principles of EWT and developed new breed. :) This is of course just an impression and not an argumented statement though, so I could very easily be wrong. I'm open minded to other approaches and uses of EW and I've said many times it is not the tool but the hand that uses the tool that will produce the results. So the comment is just of a theoretical and not of practical nature.

You also know that I agree with the idea that Forex pairs long terms cycles "could be seen" as representing continuous sideways movements. Unfortunately there isn't sufficient record backward (wave II can take up to 9 times the time needed to complete wave one), neither we will live so long to scientifically argument this :)

Although I grow the same impression that it is less likely to see some single currency hitting 0 (zero), no matter how improbable it is not impossible.

Anyway, Your conversation at FXS thread got me into rethinking the whole idea more deeply.

I have thoughts about that but never got to the point really contemplating them into an argument :)

Considering your question posted at fxs place about EWT and Forex sessions (US, EU and Asian)

Think of it this way.

As you know EWaves have fractal nature. Should I continue? :)

Of course not, but since I decided making it public post I will. So this part of the message is for those not that familiar...

Let's see then. Even on the same floor, every single trader's "mood" produces behavior which is reflected on the small time frames. Then you can see the cumulative behavioral results on daily and weekly charts.

I believe everyone get it even by now so no need to elaborate but OK, just in case something interesting comes out of this ramblings.

The only difference is in the accumulation time of single nano-fractals. While other markets have working hours, FOREX is 24 hours. It is not a question of place (and with electronic trading this is insignificant in other markets too) but of time (frames).

Time (frames) represents the accumulated behavior seen in patterns. That's why I said few times at fxs place (and you and I agree on this) that EWs are more accurate on larger time frames.

Now more significant difference in Forex is the fact that you trade pairs.

When a pair moves up or down, that could be because of few reasons:

If EURUSD is falling, that could be because:

1.USD is rising; EUR is falling.

2.USD is rising, EUR is holding steady

3.USD is rising, EUR is rising but slower than USD

4.USD is holding steady, EUR is falling

5.USD is falling, EUR is falling but faster than USD

So, there could be two different ways of how "behavior" in Forex can be seen.

1. People in general are bullish/bearish to a single currency (the above example)

or (nowadays)

2. People are bullish/bearish to a FX pair

Now the first way is the way one should observe FOREX. The pairs (one pair) them selfs are instruments or products which banks are selling to make money, and are not a true reflection of a real "mood" toward some single currency, instead they are a representation (summation) of the moods toward two currencies relative to each other. That is why we can't see the "true behavior" for the single currencies just from the pattern of one FX pair. But then, it doesn't necessarily matters (to many) since we are interested and we trade pairs. One could analyze FX from a single currency strength perspective (USDX, by assembling own indexes or like me building a RSI basket indicator :)...) but not necessarily. :)

Nowadays however, there are probably more and more participants which are seeing FOREX pairs in a more simple way (like stocks or commodities i.e.) and don't bother or even comprehend beyond that.

To make it really a ramble I'll just finish with this conclusion:

At the end, nothing of this really matters.

The only really important thing in any venture is neither your abilities neither the tools you have. But the level of confidence you have in both your skills and your tools. First two are prerequisites, but without the confidence you are not getting anywhere. You will either not do anything or produce poor results because of the lack or low confidence...

Build your confidence. Throw in some Money Management, it will help you. :)

Bear, tnx for your mail, hope everything's fine home, and a warm hi to bear family.

Dejan

PS. Bear, too bad fxs thread is not quite an appropriate place for this kind of ramblings, so too bad all those visiting there won't see it (or perhaps not :), they are saved from bore theoretical punishment :D )

Any way I'm making it public in the Blog.

Monday, July 24, 2006

Apology

I made a very stupid and unpleasant spelling error in the previous post (which is corrected now) and I would like to apology to the guy from Poland for the mistake.

It is our Cyrillic habit of writing as we speak, and misfortunate similarity of certain English words that contributed to making the mistake.

So once again I apology to my friend from Poland.

Dejan

Sunday, July 23, 2006

For my friends

This post is dedicated to my dear friends.

At the time I decided to move from MTec, my friend Stojce prepared this Blog, but also a Google Group and a Forum, for me to decide what will be the most appropriate medium for my ramblings.

Since I was not getting much of a feedback and participation at MTec, and that is why I decided to move out, creating a Forum didn't sounded like a good idea to me. Groups are also fine if there is a collaboration or if you want to limit access to selected people (members. So Brain Logging sounded most appropriate at that time.

Well, a month or so ago, I started to use that group stojce created before, as a kind of a notebook, a place were I send short comments and Charts from many different pairs and Indexes, usually at the end of the week. It is not much of an analysis, rather just my quick notes, drawn on the charts. I started dong that as a coincidence of two cozy things: one is the option of ProRealTime Charts to mail the chart directly from the application, and the second is the option to publish posts in Google group by mail. Since I use to look at some charts available with ProRealTime (not Forex), I started sending them just as notes, that will be accessible to me at any time from any place, and by the way, they will be automatically organized.

Now, since I'm going on a vacation in a few days, I decided I should make this notes available to my friends and to few of the people that were kind to share their thoughts, questions or just to say hi. I appreciated, and you know, your questions were always very stimulating for me. I'm doing this just to keep you busy while I'm gone :).

Few persons that I don't have a contact with, can also send their mails so I can add them. They are regular and frequent visitors to my blog:

the one from Argentina, one from Singapore and the one from Pleven, Bulgaria.

If the visits I get from Sofia (Bulgaria) are from Eftim, I'd would be glad to add you too. The one with the Forexmasters nickname can send mail too. The guy from Poland, I don't know your name, I presume it is main1 from MTec, confirm by mail if it is you.

This is for those very few fellows Macedonians that are visiting my Blog, ќе ми биде мило ако ме контактирате за да може да си помуабетиме на темава.

That's it from me, I'm off for two weeks, warming my old bones in a warm beach sand.

Take care,

IDejan

PS. For those few I mentioned, I expect your mail by Monday evening (GMT+1) when I'll be sending the link...

PSS. You may find it funny and laughing, but it is really much easier to me to write comments about markets in English then in my Macedonian (practically no trading terminology..) that's why even my private notes are in english... don't ask me how much time it took me to write those few analysis of few stocks from MSE (Macedonian Stock Exchange)

Friday, July 21, 2006

NEW video analysis

21 July Daily Update

...[A possible break below 1.247 low to 1.2394/38 (current price 1.2489)...first target up is 1.2580 to continue to 1.2665/78 to 1.2720. Break above that to retest 1.286 to 1.2893]...

Current daily high at 1.2678 but looking at the momentum it looks like it could make to the above levels 1.2707<>1.2715

JPY

...[possible continuation up to 118 levels then reverse down]... (current price 117.65)

Made a high 117.87 to reverse down, current low at 115.91, most probable bottom at 115.68/62. Below that 115.10<>114.89...

AUD

...[to bounce from 0.7434]... (current price 0.7445)

bounce was from 0.7405 not a clear targets here, probably not higher than 0.757<>0.759

GBP

...[probably up to 1.855 (break of the 1.817 bottom down to 1.7950/35)]... (current price 1.8270)

Now right on 1.855 target (current high 1.8555). If higher, then possibly up to 1.8623

In general, you are now hunting an Minor* to Intermediate* top (On xxxUDS) and bottom (on USDxxx) pairs, meaning that if you position right, you can expect very very nice ride down (and it could serve even for the Primary* move down).

If I'm right, only the next move, and only on GBPUSD would be more than 1,200 pips. So no need to overexpose your self with huge leverage. (targets down after competition of the current action)

Looking at EUR it seems that this correction up could only be the first leg of a correction so we can expect one more down and one more up by the 24-31 of august (possibly as I mentioned above, to retest 1.286 to 1.2893)

However, it is my opinion that hunting this top/bottom would be very very rewarding. If played properly of course. If not, chances are (since it is a wave B) you get clean swiped.

I'd appreciate to hear your thoughts on the current market situation.

Take care,

idejan

*explanation for those that are not familiar with Elliott Wave terms

Minor translates to - Monthly, Weekly, Daily to 240 min moves

Intermediate - Monthly, Weekly, Daily

Primary - Quarterly, Monthly, Weekly