Here's the spot to hang-ten on an "A" wave

KNOW WHAT OTHERS DON'T

Welcome to my Market Directions ramblings.

I mainly focus on Major Forex pairs.

The idea is to grasp Intermediate to Longer term market moves.

I use different aspects of Technical Analysis and I take into consideration economic news data, but just in conjunction with my technical analysis.

Comments and criticism are welcome as long as they are constructive and will help both readers and me to improve our understanding of markets moves.

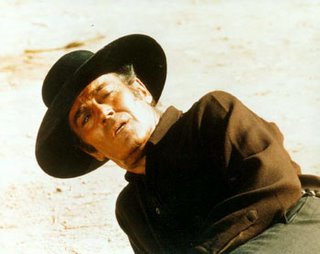

The draw begins and euro is shot thru' the heart, the bullet whipping his body 180 degrees -- he falls to the ground but he ain't dead yet.

Euro: Who are you?

Dollar: (takes off the harmonica hanging around his neck, walks up to the sprawled Euro and places it in his mouth. Euro's eyes start wandering as his mind flutters in an attempt to determine the significance of the harmonica -- then recognition arrives as he realizes he himself had placed this very same harmonica in the mouth of Dollar when he was down and out back in late 2004; a mere shadow of himself -- and with Bill Gates and Warren Buffet taunting and screaming insults at the downtrodden greenback.)

On the charts is the drop from beginning of 2005. Since I believe the chart is clear enough no need to explain it.

On the charts is the drop from beginning of 2005. Since I believe the chart is clear enough no need to explain it. But there is a possibility of a correction to go to upper levels 1.2040 to 1.2160

But there is a possibility of a correction to go to upper levels 1.2040 to 1.2160

The Mighty Wave Code :)

The Mighty Wave Code :)What can I say. I might be missing something or am I overdosed with EW and I'm seeing things? :)

Not shown here, but interesting to mention is the fact that in the fifth wave on the chart, while number of Readers made to that new High (5), number of page views diverged and made lower high. Typical for 5th waves (more participants, less participation - volume; and divergence in oscillators).

As seen on the chart first drop made to exactly 61.8 fib, then retraced typically for ZZ corrections 50% (55% exactly) of the first drop from the High, and the next drop was exactly 100% extension of first drop A from the B or as on the chart C=A.

This goes as wallpaper on my desktop to remind me of how true Wave Principle is.

Joseph, you could send link to your friends at EWI :)

ID

Joseph,

Joseph, Taking this as wave 2 of a larger (c) down, with wave 3 being only 100% of wave 1, would get NIKKEI down close to ZERO value.

Taking this as wave 2 of a larger (c) down, with wave 3 being only 100% of wave 1, would get NIKKEI down close to ZERO value.