Hi

I just published a video explaining that good call on NZDUSD I've made on 21 of February 2006.

Bear in mind that this is a selected successful call, after the fact, (typical for services :) ).

I've chosen this call as a good example of a nice C wave.

There are and will be calls that would not work as this one. Although there were good confirmations for this particular one:

It drop below Wave A end point (low) and below 61.8 Fib Extension. It also made below it's internal subwave A (or 1) end point (low) giving another confirmation for a C of a C and it made below my most important MAID (green line) indicating possibility of going to the next MAID (gray line). My modified RSI was also pointing down (not shown on this video), so anyway there was a strong confluence for calling this wave C at that time.

I'll leave you watch the video now.

Take care

ID

http://www.freewebs.com/waveid/video/NZD%20Call.html

KNOW WHAT OTHERS DON'T

Welcome to my Market Directions ramblings.

I mainly focus on Major Forex pairs.

The idea is to grasp Intermediate to Longer term market moves.

I use different aspects of Technical Analysis and I take into consideration economic news data, but just in conjunction with my technical analysis.

Comments and criticism are welcome as long as they are constructive and will help both readers and me to improve our understanding of markets moves.

Thursday, March 30, 2006

Monday, March 27, 2006

JPY update

It made only to 117.6 since my previous post, and broke down to mentioned support area of 116.9<>116.4 made low exactly at 116.4

It made only to 117.6 since my previous post, and broke down to mentioned support area of 116.9<>116.4 made low exactly at 116.4On the chart is what I consider a good argument for my view.

The fact that I see possible strong Dollar in other pairs at least in near term makes me uncomfortable a bit, but still this latest development gives me confidence in my view.

As you can see on the chart, C made to exactly 61.8 Fib Extension of the previous move, returning a strong IM drop down, which after a correction returned again a strong IM drop down.

Now 117.39 low (smaller wave 1 end) is critical for this drop to qualify for wave 1 of larger 3rd, and we need a 5th down to strengthen this view.

Break below wave 1 low 115.49 should give strong move down in a 3rd wave down.

Alternative is wave 1 being wave A IM of a ZZ, in which case 3rd will become C and will finish the drop down.

I haven't done a follow up of my Market Updates for a month, last call overshot my targets up significantly.

AUD was the best of all, pinpointly accurate, returning more than 400 pips since then and will probably make few hundreds more to just below 0.68. NZD also turned to an excellent call and it adds to what I mentioned somewhere before, that 3rds and Cs are the most easier to spot, predict and trade, with lowest risk and with greatest reward. I've looked at NZD because Joseph draw my attention on it and it returned almost 600 pips since than. I believe it will make some more before it finishes this drop.

I'll try preparing an update for EUR, GBP, CAD but don't expect too much.

ID

Joseph, NZD!

See my post (chart) from 21 Feb... This drop and the whole correction should be very close to bottom if not finished, probably 0.5990 to 0.5940 and the next move up to 0.65 to 0.67

We should wait and see the development before we decide if this would be continuation up of a larger degree C or just first leg A of B of larger B.

There is a slight chance of seeing one more move down (possible wave 5 if this drop C develops IM...) below mentioned target support of .599 <> .594 but even so I expect a min move up to .635<>.64 first.

Once again I don't follow NZD so take it with reserve.

ID

We should wait and see the development before we decide if this would be continuation up of a larger degree C or just first leg A of B of larger B.

There is a slight chance of seeing one more move down (possible wave 5 if this drop C develops IM...) below mentioned target support of .599 <> .594 but even so I expect a min move up to .635<>.64 first.

Once again I don't follow NZD so take it with reserve.

ID

Sunday, March 26, 2006

JPY point

Hi friends

I'm just taking a rest addressing some private issues.

I just want to point to something that deserves attention, especially to you Joseph.

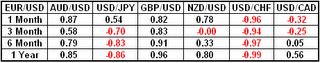

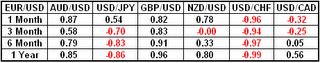

This is a Correlation Table from Dailyfx.com FXCM website.

As you can see on a yearly basis all pairs except USDCAD have had a fairly strong correlation with EURUSD. GBPUSD and USDCHF strong and constant correlation.

What is interesting and what I want to draw your attention at, is that USDJPY lost it's good correlation it had with EURUSD, and in fact shifted to a relatively good negative correlation last month.

(pay attention if the pair is XXX-USD or USD-XXX so USDJPY -0.86 is good positive correlation with EURUSD meaning both EUR and JPY moved in the same direction against the USD most of the time).

Below 116.90/40 is a good confirmation of a possible continuation down to 113.8 to 112.70 to 110.6 but if you want even better confirmation, break below 115.44 March 1 low will provide it.

Above recent high @ 118.48 and above 119.17 would make me consider 124 as a serious possibility.

Intraday, a most probable correction up to 117.75<>117.87 before any continuation down.

Take care all of you,

ID

I'm just taking a rest addressing some private issues.

I just want to point to something that deserves attention, especially to you Joseph.

This is a Correlation Table from Dailyfx.com FXCM website.

As you can see on a yearly basis all pairs except USDCAD have had a fairly strong correlation with EURUSD. GBPUSD and USDCHF strong and constant correlation.

What is interesting and what I want to draw your attention at, is that USDJPY lost it's good correlation it had with EURUSD, and in fact shifted to a relatively good negative correlation last month.

(pay attention if the pair is XXX-USD or USD-XXX so USDJPY -0.86 is good positive correlation with EURUSD meaning both EUR and JPY moved in the same direction against the USD most of the time).

Below 116.90/40 is a good confirmation of a possible continuation down to 113.8 to 112.70 to 110.6 but if you want even better confirmation, break below 115.44 March 1 low will provide it.

Above recent high @ 118.48 and above 119.17 would make me consider 124 as a serious possibility.

Intraday, a most probable correction up to 117.75<>117.87 before any continuation down.

Take care all of you,

ID

Wednesday, March 22, 2006

Nobody loves me! :) :)

Yeah, after I leave, only then do people start opening up their souls and pondering why I felt like I got a giant kick in the ass. :) :)

It was more fun with my ex-wife in divorce court, where I was given a lesson in reverse leverage and a sobering glimpse of the Promised Land -- where the water tastes like wine, but all the while one's rear end just keeps puckering up.

But what the heck, problems are meant to be solved -- just splitting never helped nobody nohow, hehehehe.

I see that my friend ID continues to underestimate himself, belittle his knowledge and teaching skills -- all this, notwithstanding the severe admonishment he delivered to me in an email, wherein he touched upon my "lack of confidence in my EW skills" :)

And, where the heck was Bear? He reminds me of the woman you complained about her lover -- "he flies in like a bat, tickles me silly for a couple nanoseconds and then vanishes for months."

Just because I was smart enough to escape from the rat race at 39 doesn't mean I gots to do all the work! :)

Change is a fact of life. So, how can this be made better?

Dialogue is the only answer. This is a 2-terminal universe; masturbation is the only activity that it encourages be done alone!

But its got to be a 2-way street with multiple givers -- and I mean that -- multiple givers, many, many individuals putting their thoughts out, questioning others' analysis, asking stuff, getting things cleared up, making calls, refuting calls .... and so on .... you gots the idea?

A Forum then?

Its called Dialogue and its up to the participants to make it illuminating.

The 2 best posters at Moneytec were (are) Idejan and Fxsurfer. The former fondles, caresses and consoles the dead, while the latter rattles their bones with 20-lot, multiple daily ejaculations.

Had no idea forex was going to be this entertaining; even if it makes me go broke -- still highly worth it! :)

It was more fun with my ex-wife in divorce court, where I was given a lesson in reverse leverage and a sobering glimpse of the Promised Land -- where the water tastes like wine, but all the while one's rear end just keeps puckering up.

But what the heck, problems are meant to be solved -- just splitting never helped nobody nohow, hehehehe.

I see that my friend ID continues to underestimate himself, belittle his knowledge and teaching skills -- all this, notwithstanding the severe admonishment he delivered to me in an email, wherein he touched upon my "lack of confidence in my EW skills" :)

And, where the heck was Bear? He reminds me of the woman you complained about her lover -- "he flies in like a bat, tickles me silly for a couple nanoseconds and then vanishes for months."

Just because I was smart enough to escape from the rat race at 39 doesn't mean I gots to do all the work! :)

Change is a fact of life. So, how can this be made better?

Dialogue is the only answer. This is a 2-terminal universe; masturbation is the only activity that it encourages be done alone!

But its got to be a 2-way street with multiple givers -- and I mean that -- multiple givers, many, many individuals putting their thoughts out, questioning others' analysis, asking stuff, getting things cleared up, making calls, refuting calls .... and so on .... you gots the idea?

A Forum then?

Its called Dialogue and its up to the participants to make it illuminating.

The 2 best posters at Moneytec were (are) Idejan and Fxsurfer. The former fondles, caresses and consoles the dead, while the latter rattles their bones with 20-lot, multiple daily ejaculations.

Had no idea forex was going to be this entertaining; even if it makes me go broke -- still highly worth it! :)

Sunday, March 19, 2006

Yen and Yang

Idejan,

Your comments are well said but I believe we all teach to some degree when we post, we express an idea or thought and set forth a list of reasons/criteria why we think this view is valid and look for comments feedback from others to support or invalidate our thoughts. From this we learn as a student and the cycle starts over again.

How ever I must admit that your views on Elliott Wave Analysis are some of the best or better said most complete and comprehensive that I’ve seen. While you do not see yourself as a teacher, one can learn a great deal from studying the views you share. Don’t sell yourself short. Yes there are several books and sources that one could go to learn about EW, but you have a very good understanding and are grounded in the (for lack of a better description) traditional Elliott Wave approach and you express yourself very well.

But I would suggest that the Blog would be better served as it was originally intended ( as I understand it anyway) the open exchange of ideas rather than that of a classroom. However I must confess that I receive a lot more than I put in. :)

Will try to do more.

And I must apologize to Joseph for my silence but some of the questions you asked are completely outside my area of knowledge, and I was looking for others to answer.

I do have some thoughts on divergence, the math behind the different indicators will show divergence differently but when price on it’s second thrust does not move an equal or grater distance in the same time as the first, divergence will show itself. When wave 5 exceeds wave three but the distance in the length of the waves is smaller( 5 less than 3) an oscillator will show divergence, it's all about distance and time traveled. It’s normal and can be seen with the eyes. From your posts I gather your familiar with this and I will try to put together some thoughts and publish.

Sorry to get carried away there and ramble.

I would add that everyone that comes on the blog, please comment, ask questions. Say hello! After all, it’s how we learn.

Idejan, Joseph and Stojce thank you, hope the discussion continues.

Wishing all a great weekend.

Bear

Your comments are well said but I believe we all teach to some degree when we post, we express an idea or thought and set forth a list of reasons/criteria why we think this view is valid and look for comments feedback from others to support or invalidate our thoughts. From this we learn as a student and the cycle starts over again.

How ever I must admit that your views on Elliott Wave Analysis are some of the best or better said most complete and comprehensive that I’ve seen. While you do not see yourself as a teacher, one can learn a great deal from studying the views you share. Don’t sell yourself short. Yes there are several books and sources that one could go to learn about EW, but you have a very good understanding and are grounded in the (for lack of a better description) traditional Elliott Wave approach and you express yourself very well.

But I would suggest that the Blog would be better served as it was originally intended ( as I understand it anyway) the open exchange of ideas rather than that of a classroom. However I must confess that I receive a lot more than I put in. :)

Will try to do more.

And I must apologize to Joseph for my silence but some of the questions you asked are completely outside my area of knowledge, and I was looking for others to answer.

I do have some thoughts on divergence, the math behind the different indicators will show divergence differently but when price on it’s second thrust does not move an equal or grater distance in the same time as the first, divergence will show itself. When wave 5 exceeds wave three but the distance in the length of the waves is smaller( 5 less than 3) an oscillator will show divergence, it's all about distance and time traveled. It’s normal and can be seen with the eyes. From your posts I gather your familiar with this and I will try to put together some thoughts and publish.

Sorry to get carried away there and ramble.

I would add that everyone that comes on the blog, please comment, ask questions. Say hello! After all, it’s how we learn.

Idejan, Joseph and Stojce thank you, hope the discussion continues.

Wishing all a great weekend.

Bear

Saturday, March 18, 2006

Bear, all

Bear wrote me a mail, I've wrote a reply and on the way decided to move it here.

But first, WaveID Blog was not accessible for few days because of some technical issues as I've been told by the guys from Blogger support. Everything back to order now, except that we are on a critical juncture with this blog :)

Bear, I remember your post on MoneyTec, and I understand somebody could feel not being competent enough to comment. I'm also aware that there is a difference in format between blog and Public Forum as somebody else suggested, but since we three started a kind of a discussion, we made it kind of a forum, and Blogs still have comment option. So this difference in format could be only an excuse.

You mentioned classroom, but in the classroom, even without any spoken comments, teachers get feed back. They can observe their students behavior, so they get feedback from their faces and gestures, they know if their students are getting it or not, if they are interested or not. Here, without comments it is just like Joseph said, talking to a wall. He got that feeling in this month of posting here, I had it for so long on MoneyTec, until few of you started a discussion.

I never intended teaching, I don't think I have something to teach others. I could have something to share with others. We all know more than we are aware, we use our knowledge daily, but just few sit down and write down in a more presentable and systematized manner, so others can learn from. But my knowledge is not something I've prepared for publishing of any kind, it is not systematized, and at present moment I could not commit my self into such endeavor. It could be taken out by others. Discussions, questions, being questioned and questioning others, criticizing and being criticized, sharpens our knowledge and builds up our confidence in what we know and where we stand.

I don't agree with Joseph on my EW knowledge. I'm neither being modest or undervalue my real knowledge my self. I remember a friend of my father, a wonderful artist, stone sculptor, master of his craft was giving me my first drawing lessons. I was around 14 that time, and on our first class he told me: "It is OK that you are talented. But now, and you should remember this, you should invest 1 ton of hard work and effort for every single gram of talent you have, if you want to master your art." I never mastered, since later in life I turned to Film, it kind off integrated all of my passions for different kinds of art...

So even if I am talented, I know I have years of hard work before I can claim my master degree in EW :). I might be an old fashioned guy, but nowadays people claim titles too easy. Everything is so "digest".

I know Joseph insists he learned from my posts, but everything I could be held responsible is introducing him with his old forgotten friend, his own knowledge of EW.

From one genius mind of Management Philosophy and Theory, Dr. Isak Adizes, whom I had a privilege to met in person, and to learn from his Ingenious work on Management while I was at University, I was reminded on two essential ingredients for a healthy relationship: Mutual Trust and Respect.

IMHO we should use this two ingredients in our relationship with oneselfs too. As I've posted on few occasions on MTec, meAnalyst and meTrader should meet and they should became a close and very good friends if we want good results. That relationship should be based on mutual trust and respect.

Confidence is one of the key words related to success.

As for EW, it is always good to read what different authors have to tell on the subject, but the free Elliott Wave Tutorial available from Elliott Wave International is all you need.

Just don't take EW mechanically, neither purely mathematically (geometricaly).

Best Arguments are made, when all aspects of the argument are taken into consideration.

ID

But first, WaveID Blog was not accessible for few days because of some technical issues as I've been told by the guys from Blogger support. Everything back to order now, except that we are on a critical juncture with this blog :)

Bear, I remember your post on MoneyTec, and I understand somebody could feel not being competent enough to comment. I'm also aware that there is a difference in format between blog and Public Forum as somebody else suggested, but since we three started a kind of a discussion, we made it kind of a forum, and Blogs still have comment option. So this difference in format could be only an excuse.

You mentioned classroom, but in the classroom, even without any spoken comments, teachers get feed back. They can observe their students behavior, so they get feedback from their faces and gestures, they know if their students are getting it or not, if they are interested or not. Here, without comments it is just like Joseph said, talking to a wall. He got that feeling in this month of posting here, I had it for so long on MoneyTec, until few of you started a discussion.

I never intended teaching, I don't think I have something to teach others. I could have something to share with others. We all know more than we are aware, we use our knowledge daily, but just few sit down and write down in a more presentable and systematized manner, so others can learn from. But my knowledge is not something I've prepared for publishing of any kind, it is not systematized, and at present moment I could not commit my self into such endeavor. It could be taken out by others. Discussions, questions, being questioned and questioning others, criticizing and being criticized, sharpens our knowledge and builds up our confidence in what we know and where we stand.

I don't agree with Joseph on my EW knowledge. I'm neither being modest or undervalue my real knowledge my self. I remember a friend of my father, a wonderful artist, stone sculptor, master of his craft was giving me my first drawing lessons. I was around 14 that time, and on our first class he told me: "It is OK that you are talented. But now, and you should remember this, you should invest 1 ton of hard work and effort for every single gram of talent you have, if you want to master your art." I never mastered, since later in life I turned to Film, it kind off integrated all of my passions for different kinds of art...

So even if I am talented, I know I have years of hard work before I can claim my master degree in EW :). I might be an old fashioned guy, but nowadays people claim titles too easy. Everything is so "digest".

I know Joseph insists he learned from my posts, but everything I could be held responsible is introducing him with his old forgotten friend, his own knowledge of EW.

From one genius mind of Management Philosophy and Theory, Dr. Isak Adizes, whom I had a privilege to met in person, and to learn from his Ingenious work on Management while I was at University, I was reminded on two essential ingredients for a healthy relationship: Mutual Trust and Respect.

IMHO we should use this two ingredients in our relationship with oneselfs too. As I've posted on few occasions on MTec, meAnalyst and meTrader should meet and they should became a close and very good friends if we want good results. That relationship should be based on mutual trust and respect.

Confidence is one of the key words related to success.

As for EW, it is always good to read what different authors have to tell on the subject, but the free Elliott Wave Tutorial available from Elliott Wave International is all you need.

Just don't take EW mechanically, neither purely mathematically (geometricaly).

Best Arguments are made, when all aspects of the argument are taken into consideration.

ID

Thursday, March 16, 2006

Thank you Joseph

Thank you Joseph.

Joseph is right. When you don't get feed back, you have a feeling you are talking to a wall and you are just not sure if what you are saying is good to anybody, if anybody's reading and if reading do they like it and find it useful or not.

I understand him well.

I've seen the statistics, and I'm surprised my self that quite a good number of people saw EW videos, but not a single comment. That tells me that most probably nobody like it.

That is the reason I was not finding time to post new Market Update and a continuation on JPY video and the one I've said I'll do about other indicators I use to make calls.

However I'm very glad I've started writing the first time. I've made a good friend.

Thank you once again Joseph.

ID

Joseph is right. When you don't get feed back, you have a feeling you are talking to a wall and you are just not sure if what you are saying is good to anybody, if anybody's reading and if reading do they like it and find it useful or not.

I understand him well.

I've seen the statistics, and I'm surprised my self that quite a good number of people saw EW videos, but not a single comment. That tells me that most probably nobody like it.

That is the reason I was not finding time to post new Market Update and a continuation on JPY video and the one I've said I'll do about other indicators I use to make calls.

However I'm very glad I've started writing the first time. I've made a good friend.

Thank you once again Joseph.

ID

Tuesday, March 14, 2006

Monday, March 13, 2006

USDJPY: has brought me face to face with my nemesis

USDJPY: can this pair be the ultimate gift to the alienated cognoscenti?

We know or have read about NZDJPY and AUDJPY and now recently, CADJPY -- but this is a new ballgame. Why? The downtrodden, written-off, despised, retrograde USD has risen from the dungeon and delivered a comeback, upstaging all heretofore stars, except for perhaps CAD, among the majors.

nemesis, the applicable definition here .... one that inflicts retribution or vengeance.

To me, this pair represents the foundation of what Forex is all about -- namely, a resting place for one's funds, wherein one earns a Return, directly proportional to the degree of leverage used. Capital gains are a bonus in this regard, as the primary motivation and underlying foundation of the Forex is "Carry" -- aka a comfortable, relaxed and enjoyable ride.

Depending on how much you go in with, you could earn more than what most working stiffs in America are slogging their assess off for -- Americans are masters at converting Equity into Debt, having no savings, living from paycheck to paycheck with a window of no more than 2 months before its Salvation Army time -- that 50k in equity financing, applied to USDJPY -- with leverage -- could give one of these working stiffs his ticket to eternal financial salvation.

But we gots to get the direction correct!

Amen!

That's why I'm urging all technicians not to be too flippant about their analysis -- give it careful consideration and deliberation.

This is the mother of all opportunities and we are sitting right at the threshold.

Somewhere between 122 and 101 there ought to be a clear message as to intent.

My call stands as-is but it is no mental picnic knowing that ID's analysis, which I respect more than any I do any other elliottician's, is dead against my call.

Am I destined to go down in ignominous defeat in the face of the opportunity of the decade?

We know or have read about NZDJPY and AUDJPY and now recently, CADJPY -- but this is a new ballgame. Why? The downtrodden, written-off, despised, retrograde USD has risen from the dungeon and delivered a comeback, upstaging all heretofore stars, except for perhaps CAD, among the majors.

nemesis, the applicable definition here .... one that inflicts retribution or vengeance.

To me, this pair represents the foundation of what Forex is all about -- namely, a resting place for one's funds, wherein one earns a Return, directly proportional to the degree of leverage used. Capital gains are a bonus in this regard, as the primary motivation and underlying foundation of the Forex is "Carry" -- aka a comfortable, relaxed and enjoyable ride.

Depending on how much you go in with, you could earn more than what most working stiffs in America are slogging their assess off for -- Americans are masters at converting Equity into Debt, having no savings, living from paycheck to paycheck with a window of no more than 2 months before its Salvation Army time -- that 50k in equity financing, applied to USDJPY -- with leverage -- could give one of these working stiffs his ticket to eternal financial salvation.

But we gots to get the direction correct!

Amen!

That's why I'm urging all technicians not to be too flippant about their analysis -- give it careful consideration and deliberation.

This is the mother of all opportunities and we are sitting right at the threshold.

Somewhere between 122 and 101 there ought to be a clear message as to intent.

My call stands as-is but it is no mental picnic knowing that ID's analysis, which I respect more than any I do any other elliottician's, is dead against my call.

Am I destined to go down in ignominous defeat in the face of the opportunity of the decade?

Subscribe to:

Posts (Atom)