EW was developed by analyzing stock markets movements, but it is about the shifts from optimism to pessimism and the other way back. That's why it could be used in other areas of life too. Robert Prechter developed his Socionomics based on the Wave Principle...

It is difficult for me to explain all the market activities behind currency pairs moves, since there are lots of different involved. From hedging to international payments, banking etc and IMHO speculative trading is the smallest factor in those moves. It is probably why you will find comments about how different markets moves caused moves in Forex markets, but not in the opposite way(or very rarely).

Intermerkets correlations, currency correlations and other correlations influencing the markets is important part of the required knowledge trading any market.

I am just an amateur beginner on that field.

That's why I sincerely believe that a good complementary team of traders would be able to produce far more accurate analysis and trading strategies.

Who knows. At some point, our efforts here, could result in a small coherent an complementary team that would be able to work together.

But as I remeber, in the past Banks were providing services, now they sell products.

Currency trading instruments are actualy a products that Banks invented for the sole purpose of making money. For themselfs. That's why you can trade using extremly high leverage, and when infact there is no acctual borrowing, since you trade your colateral against others colaterals and the banks are just clearing the transactions, they charge interest on the leveraged amounts held in positions, the money that doesn't exists nowhere. A nice way to earn ton's of money, isn't it.

In the past it was, me having money in the bank and I hold a note saying I have $1, then somebody borrows money from the bank and he has $1 and all of a suden my $1 became $2. Nowadays credit extends 100 of times in a misterious ways.

That's why I posted the Rhino analogy. Don't try fighting the Rhino. Find way feeding of his back.

I agree with you that you can look at Currency pairs as two individuals, since they are consisted of two different single currencies. So when one Currency pair is falling or rising, it should be because of few different reasons. Let's say we are talking of EURUSD and the pair is moving UP. That could be because:

1.EUR is rising; USD is falling.

2.EUR is rising, USD is holding steady

3.EUR is rising, USD is rising but slower than EUR

4.EUR is holding steady, USD is falling

5.EUR is falling, USD is falling but faster than EUR

(where rising/falling/holding - implies to rising/falling/holding of a single currency related to a basket of other currencies)

I even developed an MT4 indicator (with Stojce programing it) which tries to mesure the Relative Strength of a Single Currencies (based on the RSI of a Basket of Currencies) and presents a RSI of few Major Single Currencies in one indicator window (you've probably seen it in some of my posts).

--------------

The Wave CodeI said I'll recycle some of my thoughts on what I consider to be important issues.

So here are some of my thoughts related to all those approaches looking at price in any mechanical, mathematical or any other way that presumes that future PRICE is predetermined by past Price action, Time, Fundamentals, Mathematical Correlations, linear or non linear.

In my opinion, It is NOT.

You can find answers and some clues, but you could not know the ultimate answer. Just as I can't tell my Bank Account Balance 10 tears from now, based on my historical earnings. It will greatly be determined by my readiness, my mental, emotional and physical fitness to cope with LIFE, recognizing my true "expectations", using my real abilities and finding the best possible way fulfilling them all at right time.

You will, and you probably already have heard many times, about different aspects of Price being this and that, repeating it's own actions, about markets having memory, "Price being a mathematical numeric within the structure of Time that it must conform to, because they operate within the same constants and variables"; and at the same time from those same people you've probably heard about the "disturbances", "fog", "disparities", etc. and that Price will revert back in track with it's fundamentals (what ever they are).

But if the first part of all those statements about price are true, then the last one could not be true. And there could not be any such things like "fog", but could it simply mean than it's our expectations that are in a disagreement with price and that we should revert our expectations back to the Price, and not waiting the Price to revert to it's fundamentals?

And we've came to

Expectations.

This was inspired and written by something addressed to me on MoneyTec, and shortly it was that "expectations don't set long term price levels" or something like that.

In fact,

PRICE is EXPECTATIONs. It is the Aggregate of all Expectations and The Agreement of the MASS.

(to be continued)

ID

Just one little wonder.

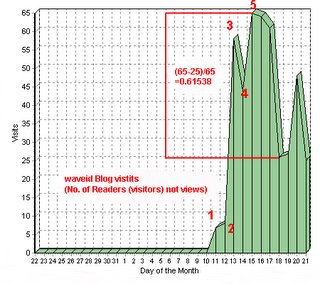

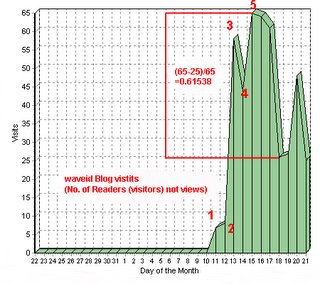

It's a visits (represented by a number of single visitors not a number of visits which is different graph) on this Blog from it's begining till today (not updated in the last few hours and the last point is now higher then the previous low @ 25).

Regression to the mean is a very common character of Forex markets and indeed any markets, some look at these situations and simply call then over bought/sold giving contrary trades but of course for every buyer there is a seller.

Regression to the mean is a very common character of Forex markets and indeed any markets, some look at these situations and simply call then over bought/sold giving contrary trades but of course for every buyer there is a seller.

Looking at currency pairs correlations, we can see that NZD lost it's correlation with both AUDUSD and EU pairs, meaning that when other pairs move strong on dollar NZD doesn't.

Looking at currency pairs correlations, we can see that NZD lost it's correlation with both AUDUSD and EU pairs, meaning that when other pairs move strong on dollar NZD doesn't.